Algorithmic Trading – Weekly Trend and Trade Forecast

Algorithmic Trading System: A few of investors have mentioned that it would be nice if I shared the AlgoTrades chart on a weekly basis so they could get a feel for how the system sees the market and what it’s likely to do in the coming week.

I strongly agree that you should get a weekly update to keep a pulse on the market and system. So going forward each Monday I will send you market snap shot of the system chart along with my analysis.

Last Monday the US stock market breadth along with my shot term cycle, and momentum indicator all reached levels which typically signal weakness for stocks in the coming weeks. Once the levels have been reached with my indicators the market ins most cases takes 5-12 days before lower prices actually start.

After Fridays ugliest “up” days in history along with today being day 5 (the start of weaker prices) we should expect volatility to rise and stocks to become choppy this week and next.

Ugliest Up Days Report:http://jlfmi.tumblr.com/post/102609531425/yesterday-was-one-of-the-ugliest-up-days-in-history

—————————————————-

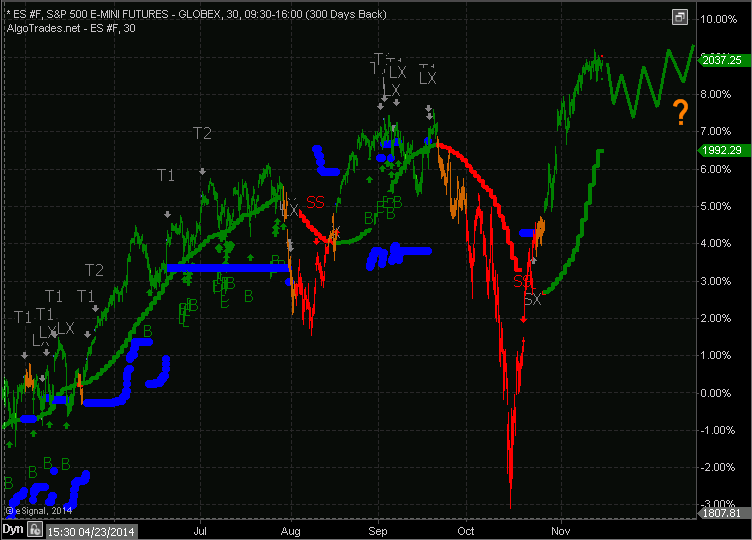

Algorithmic Trading Trend, Forecasts and Trades

The current market trend remains up and the algorithmic trading system will be looking to buy into weakness. I expect a new long trade will be entered this week, possibly today.

My forecast is that we see some weakness that may last 3-10 days and during the time the market is likely to bounce around. If this is the case we should see one of two things happen, we get into a new long trade early and watch the market fluctuate without reaching our first target until the market consolidates and continues to move higher, or we have a serious of trades where the system catches the Ping-Pong price action between support and resistance, much like what we have seeing in the past.

There is always the chance of a market correction that turns into a down trend, at which point the long position would be stopped out but its more likely we get a long trade or three before price rolls over and start another down trend.

Extreme sharp price action like we saw in October is not ideal for the AlgoTrades system. It tends to avoid them and will look to get involved once a trend is clearly established. The focus is buying into weakness during a rising market, and selling strength during falling prices.

View the chart below with my rough forecast of price and of the AlgoTrades Algorithmic Trading System.

Algorithmic Trading System

Chris Vermeulen