Types of Algorithmic Trading Strategies

In the previous post we talked about how algorithmic trading systems were developed and the process. This post is about the different types of algorithms that can be designed and traded.

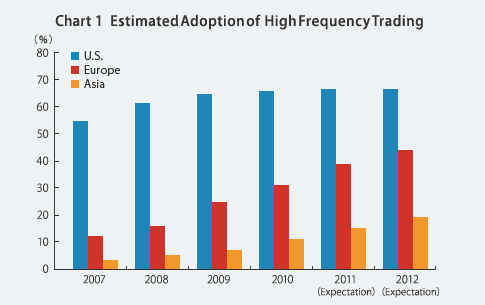

High Frequency trading: A program trading platform that uses powerful computers to transact a large number of orders at very fast speeds. High-frequency trading uses complex algorithms to analyze multiple markets and execute orders based on market conditions and liquidity levels. Typically, the traders with the fastest execution speeds will be more profitable than traders with slower execution speeds.

High-frequency trading became most popular when exchanges began to offer incentives for companies to add liquidity to the market. For instance, the New York Stock Exchange has a group of liquidity providers called supplemental liquidly providers (SLPs), which attempt to add competition and liquidity for existing quotes on the exchange. As an incentive to the firm, the NYSE pays a fee or rebate for providing said liquidity. The SLP rebate was $0.0015. Multiply that by millions of transactions per day, and you can see where part of the profits for high-frequency trading comes from.

Algorithmic trading: Algorithmic trading is any trading activity carried out with the help of an automated computer system. It can be formally defined as “placing a buy or sell order of a defined quantity into a quantitative model that automatically generates the timing of orders and the size of orders based on goals specified by the parameters and constraints of the algorithm.” Or, in short, “Algorithmic trading is about using a set of rules to finesse trade execution.”

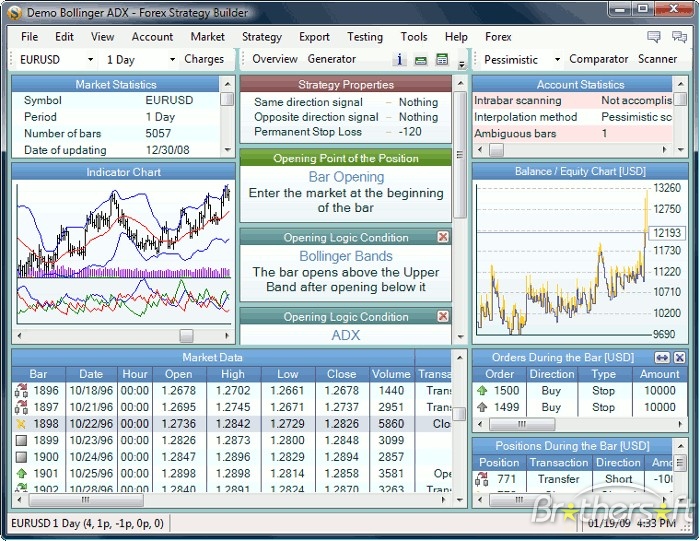

Simple Technical Analysis Program trading: Trades based on signals from computer programs, usually entered directly from the trader’s computer into the clients brokerage system and executed automatically.

Algorithmic Trading Trends

Algorithms have sparked a fundamental change in everything—an exciting era of opportunity for those who innovate. It isn’t easy to foresee all the algo trading landscape contours precisely. But some broad trends are referred to here. In the coming years, the evolution of the algorithmic trading landscape will result in firms re-evaluating and evolving their views, trading strategy, asset-class mix, the relationship between buy-side and sell-side, and the people they employ along with technology being used.

Algorithms Migrating to Currencies

The use of algorithms in multiple asset classes will continue to increase. There are strong indications to date that algorithms also have a place in the $2 trillion-plus global foreign exchange market. Market participants have long recognized that established equity trading techniques such as baskets and order slicing apply to FX. They are quickly finding out that algorithmic trading can be more effective in the fast-moving FX markets in some cases. It is a fact that algorithms in FX markets are still at an early stage relative to the equities markets, but it will not long for it to overtake the amount being used in the equities marketplace.

Fixed Income Next

The introduction of algorithmic trading is being explored in the fixed-income market. It is happening slower than in foreign exchange. The slow uptake is due to a different market structure in terms of how it functions and operates. Algorithmic trading thrives in order-driven environments and greater price transparency than that of fixed income. Once European markets embrace what is happening, algorithmic trading across fixed-income markets gets a boost to take off.

Algorithms Connect Dark Pools Creating More Liquidity

Technically, any off-exchange marketplace that executes shares anonymously (without quoting) could be considered “dark” because it provides limited opportunity for information leakage. According to TABB Group, crossing networks handle five to eight percent of buy-side flow. Some broker-dealer dark books include Goldman Sachs’ Sigma X, Credit Suisse’s CrossFinder, and UBS’ Price Improvement Network (PIN). In contrast, crossing networks include ITG’s Posit, LiquidNet, Instinet Crossing, NYFIX Millennium, and Pipeline. Algorithms are used extensively by broker-dealers to match buy and sell orders without publishing quotes. By controlling information leakage and taking both the bid and offer sides of a trade, broker algorithms enable improved liquidity, pricing on shares for clients, and higher commissions to brokers.

Cross-Asset Trading Adoption of Algorithmic Techniques

Traders quickly find cross-asset trading opportunities to generate Alpha (risk-adjusted “excess return” on an investment). Technology has enabled traders to monitor and respond to multiple liquidity pools across various asset classes. A trader may, for example, buy equity, hedge with a derivative of the equity, and take out an FX position—all within the same strategy. We will see an uptake in innovative algorithms to capitalize on high-frequency cross-asset opportunities. The sophistication of these new combinations requires detailed simulation and careful testing. Modern algorithmic trading platforms provide the tools to back-test, profile, and tune these new types of strategies before deployment.

Algorithms for News Analysis

Markets are moved by the news. Buy-side firms and traders are increasingly interested in strategies that can analyze news events and their impact on a firm or industry. If the algorithm can analyze and react to news faster than a human trader, advantages can be realized. An algorithm could, for example, alert a trader if the news is released on company X and if the company stock rises or falls by, say, one percent in the value of that stock within five minutes. For example, Reuters News Scope Real-time product lets clients use live news content to drive automated trading and respond to market-moving events as they occur. Each news item is ‘meta tagged’ electronically to identify sectors, individual companies, stories, or specific items of data to assist automated trading.

System Types Conclusion:

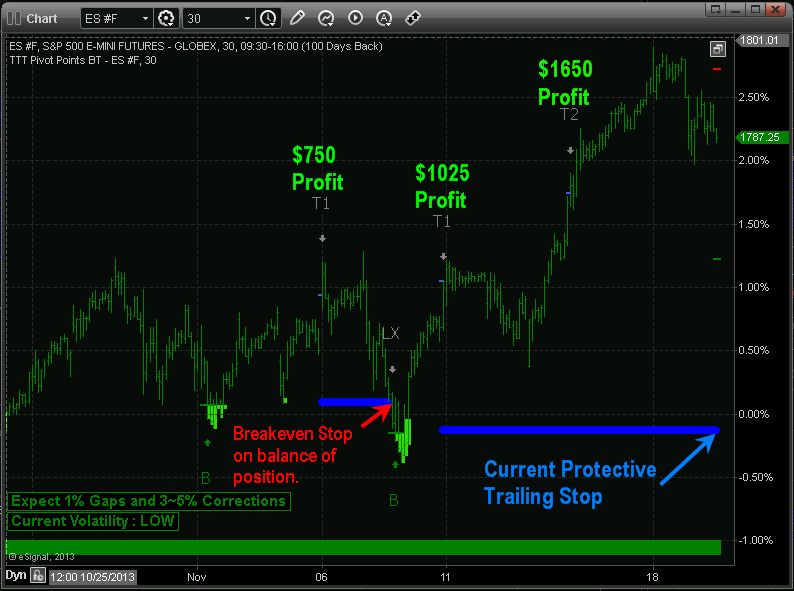

While there are many ways to build algorithmic trading systems keep in mind these main stream ways talked about in this report is not exactly what we do here at AlgoTrades.net. Our algorithms are low/slow frequency algorithmic investing systems taking advantage of intermediate cycle lows and highs in broad market using the S&P500 index. Learn more about our simple automatic trading system.

ALGOTRADES – ALGORITHMIC TRADING FOR INDIVIDUAL INVESTORS

Chris Vermeulen

Technical Traders Ltd.