INNER-INVESTOR OUTLOOK APRIL 2014

US EQUITIES TECHNICAL ANALYSIS:

The analysis in this newsletter will calm your nerves and allow you to ride trends longer. Knowing what the current trend is will prevent you from second guessing your positions. The information we offer is a tool to help you make more money and strengthening self-discipline through confidence.

S&P 500 Monthly Index Chart – BIG PICTURE

Here is an updated chart showing how the SP500 index (US Stock Market) is nearing its key support trend line. We are likely to have a multi month topping phase before the next bear market will start. But the trend line needs to be broken first. But until our cycle analysis and this chart breaks down, long term investments should continue to be held.

Tightening stops and reducing position sizes for new trades is not a bad idea. We are starting to see divergence on the chart below and that tends to be an early warning of a top.

The chart below is the scenario I would love to see unfold in the next 6-8 years. This would truly give the baby boomers some golden years. But either way, we can make big money trading with the trend (Bull or Bear).

This chart is forecasting a 2-3 year correction (consolidation) to start this year. The market could trade sideways or lower by roughly 15 – 20% before starting another major bull market. This would not be a market crash, but a tamed bear market similar to what occurred in 1981- 1983.

A pullback in equities would likely be triggered by the unwinding of QE, rising interest rates and a rising dollar. The dollar index is shown at the bottom of this chart, with the purple line showing my expectation for the long run.

Economic & Stock Market Cycles:

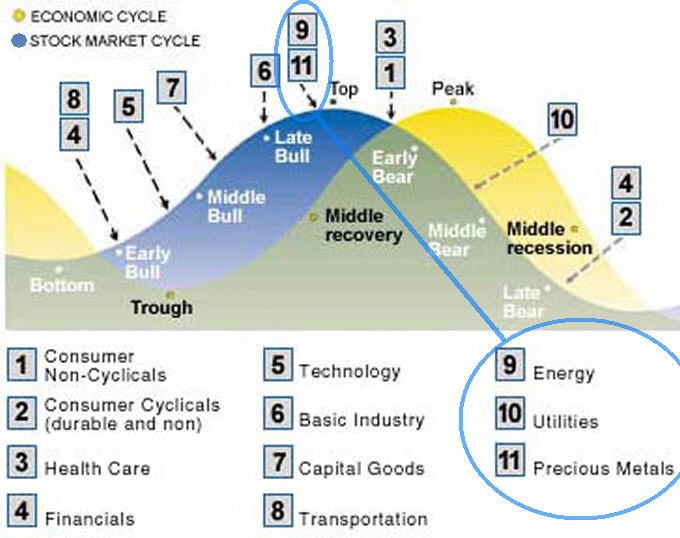

The chart below, courtesy of Donald W. Dony, shows how the market moves in terms of sectors and commodities.

Focus on the stock market cycle (blue cycle) and the numbers 9, 10, and 11. In the recent weeks we have seen money move towards the safer investments. Utilities have performed very well, and so has the energy sector. Precious metals on the other hand showed great strength in January and February and consolidated most of March. Typically commodities perform well in the late stages of a bull market which is where the market seems to be trading now.

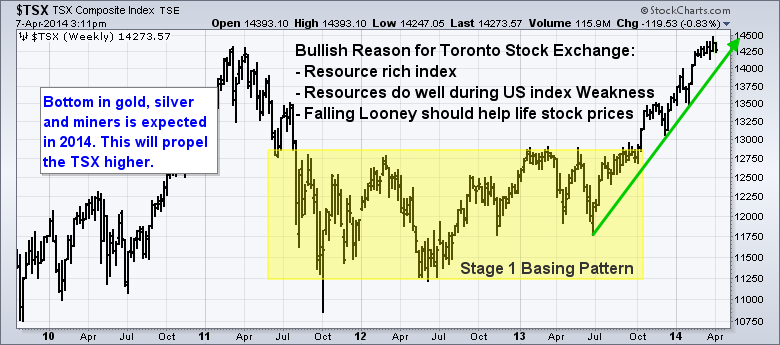

Canadian Equities:

The Canadian market has been strong. TSX Composite is resource-weighted and Canadian stocks lagged their counterparts around the world last year meaning it’s time for to play catch-up. These equities are not as overextended as many think and may hold up well when the US market corrects.

Because of the TSX’s higher weighting in late-cycle stocks (resources), it’s not unusual for Canadian stocks to lag in the early stages of a bull market, catch up in the late stages, and outperform toward the end.

The Risk-Off Trade Is Slowly Unfolding

Comparing stocks, gold and bonds, each look as though they will change its trend soon.

Most of my timing and trading is based around what I call INNER-Market Analysis (Market Stages, Cycles, Momentum and Sentiment). Using these data points we can diagnose the overall health of the market. Knowing the overall strength of the market allows us to forecast short term trend reversals before they happen with a high degree of accuracy.

Fear is starting to enter the market and money is rotating out of stocks and into the Risk-Off assets like gold and bonds.

Below is the updated chart showing this rotation…

INNER-Investor Monthly Conclusion:

The most valuable information this newsletter provides is the current stock market trend and its trend change alerts.

The month of March was volatile. While the overall trend still remains up, we have started to see high volume distribution selling in the marketplace. You can read my recent article about how the stock market leaders are now leading the way lower… ETF Trading Newsletter – Click Here

The question everyone wants to know is when stocks will bottom or is this the start of a bear market?

The truth is no one really knows, so all we can do is follow the market. The better you are at identifying trend changes and can react to them, the more money you can make.

It is important to understand that all pullbacks and down trends start the same way. It is best to protect your capital and move to cash once a new trend is born (Green bars or Red Bars). Then be patient and wait for a new trade setup with the current trend.

The chart below shows the current pullback and this strong pullback was enough for our automated trading system to warn us (orange bars) to avoid any new trades in the market.

Since our grand opening of our algorithmic trading systems in late February our clients have generated a 7.6% return on their portfolio which is $3,800 cash in their trading account. Being able to identify the current trend, timing short term overbought and oversold market conditions, and managing positions to profit from the monthly wave like patterns in the stock market is the key to consistent long term success.

Just to be clear, we are not yet in a bear market. But our analysis shows the US stock market is likely starting a major stage 3 topping pattern. This will likely take months to unfold just as all bull market tops do. And during this process it is going to be very difficult for the average investor involved in the stock market to make money. Expect a lot of trend reversals and range bound trading going forward.

As part of this newsletter you will receive an email alert each time there is a trend change in the broad market so you stay up to speed with the market direction.

Have a great month!

Sincerely,

Chris Vermeulen

Founder of www.AlgoTrades.net