Quantitative Trading Developer For Automated Trading Software

As a quantitative trading developer, it will be your job to create and test automated trading software. This program helps traders determine the optimal time to purchase and sell various investment products.

In this role, you will create and maintain automated trading software that relies on quantitative analysis to make trades.

This will involve working with large data sets, developing algorithms to detect trading opportunities, and backtesting these algorithms to ensure they work. The ability to think critically and solve problems will be just as important as your technical expertise, but if done well, you can build automated single asset revesting systems to manage your money.

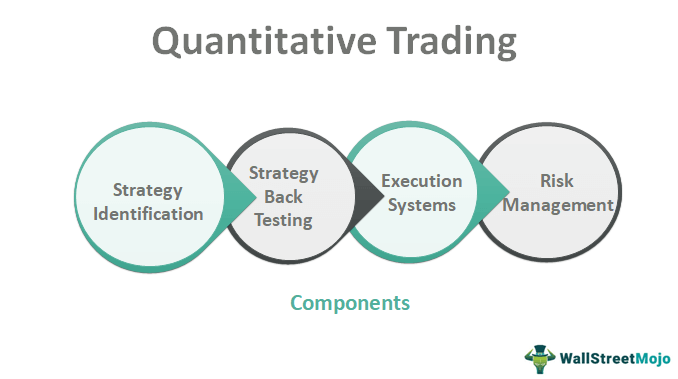

Explaining quantitative trading and its importance in finance

Quantitative trading has many benefits, such as taking advantage of market failures, trading with a high degree of accuracy, and managing risk better.

- The extra return on a portfolio over and above the market’s recovery is known as alpha and can be generated through quantitative trading.

- As traditional active management tactics have become more difficult to deploy to generate alpha, the financial industry has increasingly relied on quantitative trading in recent years.

- Because of this, the demand for skilled quantitative traders and programmers who can create and implement effective trading strategies is rising.

Quantitative developer Skills & Qualifications

A few essential skills and qualifications are necessary to be a quantitative trading developer.

- Firstly, it is essential to have a solid background in mathematics and computer science.

- Second, you must have worked with financial data and built statistical models.

- Lastly, it helps to have prior experience with creating automated trading software.

An automated trading program that a quantitative trader developer creates and keeps running efficiently. Stocks, bonds, options, futures, and commodities are just some of the many types of securities the software needs to handle.

The developer needs to have a deep knowledge of the financial markets and the expertise to create algorithms that can spot promising trading chances. In addition, the computer needs to be able to make deals rapidly and accurately.

The developer’s knowledge of multiple languages and data analysis tools is required. The developer also needs excellent analytical and problem-solving skills.

Check out: Get ready for where the markets may go in 2023

Trading strategies and knowledge of financial markets

To make it as a quantitative trading developer, you need to know your way around the financial markets and different trading techniques.

This involves familiarity with both standard trading methods, developing specialized algorithms for taking advantage of them, and an awareness of how varying market conditions affect trading.

Due to their in-depth knowledge of financial markets and trading strategies, developers of quantitative trading software have a significantly better chance of success in a wide range of market circumstances.

As a result, they can construct more reliable systems that can respond to shifting market conditions and consistently turn a profit.

Techniques for backtesting and optimizing

The term “backtesting” refers to evaluating a trading strategy by comparing its potential future results with actual historical results.

Trading strategy optimization entails identifying the optimal values for the various factors that make up the plan.

Any programmer working in quantitative trading should have access to both backtesting and optimization. To see if your trading technique has been profitable in the past, you can use backtesting.

Trading strategies can be optimized by identifying the optimal values for their parameters.

Check out: CREATING A BEAR-PROOF RETIREMENT: STRATEGIES TO REACH AND SUSTAIN RETIREMENT

Quantitative developer job description & responsibilities

As a quantitative trading developer, it will be your job to make automated trading software and keep it running. A trader’s duties include:

- Coming up with and testing new approaches to trading.

- Creating and applying new models for managing risk.

- Supervising the creation of trading reports.

You will also have to check that the application complies with all applicable laws and standards and meets user expectations.

Research and implementation of new trading strategies

The main focus of your job as a quantitative trader developer will be discovering and applying novel trading methods.

For this, you will need to use your coding talents to create software that can automate the execution of trades based on massive data sets, statistical models, and market data.

You will need to be proficient at researching fresh ideas and have a solid grasp of the financial markets.

After a plan is established, it must be rigorously tested before being implemented. The traders utilizing the software must be involved in this process from the beginning.

When dealing with any form of automated trading, the job of a quantitative trading developer is crucial. This could be the ideal profession for you if you are interested in this financial industry.

Improving performance with traders and other stakeholders

Working with traders and other stakeholders to boost performance is crucial for any quantitative trading developer looking to make a name for themselves and collaborating on trading methods, conducting experiments, and analyzing the results all fall under this category.

If you want to keep your system in tip-top shape and ahead of the competition, staying current on market trends and technological advancements is essential.

Monitoring and analyzing market data to identify opportunities

To be a successful quantitative trading developer, it is essential to be able to monitor and analyze market data to identify opportunities.

There are a variety of approaches you can take, but the most critical is to put in place a system that facilitates easy and rapid retrieval of relevant information.

The software can use real-time data to monitor and analyze market data. Having a tool like this at your disposal might be invaluable for seizing chances as they present themselves. Using a database or spreadsheet is another option for monitoring market information.

This approach may take longer in some cases, but it is well-suited for processing massive datasets.

Check out: GET MORE CLIENTS AND REFERRALS: LEARN HOW TO DELIVER CONSISTENT RESULTS

Quantitative Developer Career Path, Salary, and Advancement

As a quantitative developer, your career path will be focused on developing and improving automated trading software.

Your primary focus will be developing and verifying trading decision-making algorithms and improving and enhancing current software. Strong analytical and programming skills are required for this position.

There are various variations of automated trading software, each with its pros and cons. As a quantitative developer, you investigate available options to pick software that meets your requirements. Your job description may include developing one-of-a-kind software for customers.

To move up the corporate ladder, you must keep learning and growing as an expert. Attend industry events such as conferences and workshops to stay abreast of developments and build professional connections.

If you put in the time and effort, you can get to the top of developing automated trading systems.

Entry-level positions and standard career progression

As a quantitative trader developer, you will primarily focus on developing and maintaining trading automation software.

As a trader algorithm developer, you’ll be expected to scout out new trading strategies, build code to implement them, test how well the strategy performed in the past, and then optimize its performance.

You will also be responsible for creating models for risk management and keeping an eye on trade in real-time to identify and prevent any issues that may arise.

If you want to succeed in this position, you need excellent coding skills, statistical analysis and modeling knowledge, and insight into the workings of the financial markets.

A knowledge of mathematics or physics is also practical. Developers in quantitative trading typically hold a bachelor’s degree in computer science, engineering, or a related profession.

Programmers specializing in quantitative trading often advance to positions of more responsibility within their company, such as senior quant traders or heads of trading development. When the market conditions are right, some quantitative traders go into other areas of finance, such as investment banking or asset management.

Opportunities for advancement, such as becoming a quantitative trader or portfolio manager

There are several opportunities for professional growth as a developer for quantitative trading. A career as a quantitative trader or portfolio manager is possible with the correct abilities.

These positions typically include making more nuanced decisions and carrying out a more comprehensive range of duties. However, these alternatives’ financial and professional benefits are often far more incredible.

Some people need to have what it takes to succeed in higher-level roles. To be sure, progress in quantitative trading is also proceeding in many other directions.

Those who excel at their employment can advance to management or take on additional tasks, like supervising a team of programmers or developing innovative trading techniques.

There are numerous opportunities for advancement in quantitative trading, regardless of your starting point.

Professional development resources and networking opportunities

As a quantitative trading developer, you will have access to tools for professional development and chances to meet other people.

At conferences and seminars, meeting other developers and picking their thoughts can be done. You can shop with other programmers in online discussion forums and chat rooms.

Conclusion

In the end, we’ve discussed what quantitative trading developers do and what skills they need. We also discussed the many forms of automated trading software and how they may be applied in the forex market.

The path to becoming a developer for quantitative trading can be paved in many ways.

And finally, there are many quantitative trading-specific online forums and groups, such as the Quantopian Forum and the Elite Trader Forums. These forums are invaluable for meeting other traders and developers, learning from their experiences, and offering your knowledge.

Check other services by Chris Vermeulen thetechnicaltrader.com, thegoldandoilguy.com & revesting.com