Algorithmic Trading Strategies Infographic

One of the most effective ways to understand algorithmic trading strategies infographics is through infographics. Infographics are visual representations of information that make complex ideas easy to understand.

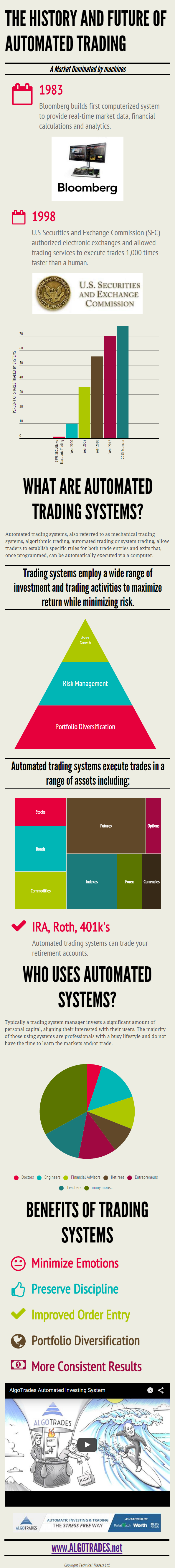

Algorithmic trading has revolutionized the way algo stock markets operate. It refers to using computer programs to execute trades based on predetermined rules and parameters.

Automated trading has become increasingly popular in recent years due to its speed, efficiency, and ability to process vast data.

In this article, we will explore some of the most common algorithmic trading strategies through an infographic.

4 Most Used Algorithmic Trading Strategies Infographic

Infographics are an effective tool for understanding algorithmic trading strategies because they allow traders to see complex data and concepts clearly, concisely and visually appealingly.

Moreover, Infographics use various elements such as charts, diagrams, illustrations, and statistics to explain complex data and ideas in a manner that is easy to comprehend.

Infographics are a powerful communication tool that can be used to share knowledge, explain complex ideas, and present data visually appealingly.

Trend Following Strategy

One of the most popular algorithmic trading strategies is trend following. This strategy is based on the principle that markets tend to trend over time.

In a trend-following strategy, traders use technical analysis tools to identify trends and buy or sell assets based on the direction of the trend.

This strategy is effective in markets with clear trends but can be risky in choppy markets that lack direction.

Mean Reversion Strategy

It is also one of the most popular algorithmic trading strategies infographics. This strategy is based on the principle that prices revert to their mean over time.

In a mean reversion strategy, traders identify overvalued or undervalued assets and take positions based on the assumption that prices will eventually return to their mean.

This strategy is effective in markets that experience regular fluctuations but can be risky in markets trending strongly in one direction.

Arbitrage Strategy

The arbitrage strategy is based on the principle that prices for the same asset should be the same across different markets. In an arbitrage strategy, traders take advantage of price discrepancies between different markets by buying and selling assets simultaneously in different markets.

This strategy is effective in markets with inefficiencies in pricing but can be risky if the price discrepancies are small or there is a delay in executing trades.

Scalping Strategy

The scalping strategy is a short-term trading strategy that involves buying and selling assets quickly to take advantage of small price movements. In a scalping strategy, traders look for assets with high liquidity and low volatility, allowing them to execute trades quickly and efficiently.

This strategy is effective in markets that experience frequent price movements but can be risky if the market is choppy or lacks direction.

Quantitative Strategy

The quantitative strategy is an algorithmic trading strategy that uses mathematical models to identify profitable trading opportunities. In a quantitative strategy, traders use statistical analysis and mathematical models to identify patterns and trends in market data. This strategy is effective in markets with much data available in algorithmic trading strategies PDFs. It can be used to identify profitable trades that would be difficult to identify using other strategies.

FAQs

Is algorithmic trading profitable?

Algorithmic trading can be profitable but is not guaranteed to be profitable. It depends on various factors, such as the strategy, market conditions, and the trader’s proficiency in programming and testing algorithms.

What are the most common trading algorithms?

A time-weighted average price, volume-weighted average price, and percent of value are three of the most used trade execution algorithms (TWAP, VWAP, and PoV).

Why does algo trading fail?

Investor uncertainty and consumer confidence are affected over time by algorithmic HFT, causing exaggerated market volatility. Negative feedback loops result in downward spirals as markets move lower.

Conclusion

Algorithmic trading strategies infographics have become increasingly popular in recent years, and infographics are an effective way to understand these strategies. Infographics visually represent complex data and ideas, making it easy to understand and digest information.

Trend following, mean reversion, arbitrage, scalping, and quantitative strategies are some of the most common algorithmic trading strategies.

Asset Revesting Engineer strategy is an investment method that tossed aside strategies like buy-and-hold and diversification in favor of holding assets that were increasing in value only.